The Best Travel Cards (For Any Traveler) That Save and Earn You Money!

Finding the best travel cards so you can maximize your money abroad is not an easy task.

To manage, keep track of, and decide which banking cards and credit cards are best for YOUR type of travel can be… A LOT. I hope we can figure out the best cards for you right now!

If you’re from the US, I’ve got you covered here. If not, check out my other article on the best travel cards for non-Americans.

Let’s start by breaking down some of the top banking cards AND credit cards and get you on your way to enjoying your travels.

Table of Contents

The Best Travel Cards to Use Abroad

So, as we know, there’s a lot to learn about card use abroad. In this post, we will talk about the best cards and why you’d want to use them to travel with.

The two cards we’re going to talk about are:

- Bank cards – This is the card you’ll need abroad to access your cash. Banks are NOTORIOUS for charging you money for using ATMs abroad, and ATMs will also charge you! So below, you’ll find the best cards to AVOID that happening. Nobody likes to pay money to access their money.

- Credit cards – It’s no secret that credit cards can literally help you travel better and more! And (if you’re a responsible credit card owner) the benefits are spectacular! So we’re going to cover the best of the best below for you.

Best Travel Cards

Quick List of Travel Cards

These are my three MUST have accounts

ATM Card

No ATM fees when getting cash out abroad!

Capital One Venture X Rewards Credit Card

My fav travel credit card! (or compare other travel cards)

Acorns Investment Account

This is the easiest way to invest if you have no idea about investments!

Charles Schwab – Bank Card (The Only ATM Card You Need!)

American travelers may be keen to get their hands on a Charles Schwab checking account for one main reason: you don’t have to pay ATM fees, ever.

No matter where you are in the world, pop your card into an ATM and don’t worry about paying for it. If the ATM charges a fee (and trust me, 95% will), the bank will reimburse you the funds. For an avid traveler, this is a huge perk.

That’s far from the only benefit, though. When you set up the account, you won’t have to provide an opening deposit; in fact, there is no minimum balance at all. There is also no monthly fee that comes with the card and account.

You may only get this card to use abroad, but it’s great to use in the US as well. If you ever need to go to an ATM, there’s no need to “find your bank’s ATM,” literally, just use ANY ATM you find, and you won’t be charged. There’s really no downside to this card at all.

TIP: I’d open two accounts so you can have an emergency backup account. This way, if you lose a card, you have another one and can easily transfer money around. Just in case your card gets skimmed as well, you can have your money spread out.

Charles Schwab card at a glance:

- You can add your card to your mobile wallet for a convenient and easy way to pay.

- Unlimited ATM fee rebates all over the world.

- No foreign transaction fees.

- No opening deposit is needed.

- No fees or account minimums.

- Use the Schwab Security Guarantee. The company will cover any losses in your Schwab accounts if there is any unauthorized activity on your accounts. Schwab automatically provides this protection.

- You can manage all your money in one place, as you only need one login to access multiple accounts.

- It is straightforward to contact the customer service team thanks to the 24/7 online chat. (There are no branches to walk in it, not that you’d ever need one!)

- Download free, easy-to-use apps on Android and iOS devices to make your banking experience a little easier.

- If you go into your overdraft, the company may take funds from other linked accounts free of charge.

Chase Sapphire Reserve & Preferred – Credit Card (I Used This One For Years)

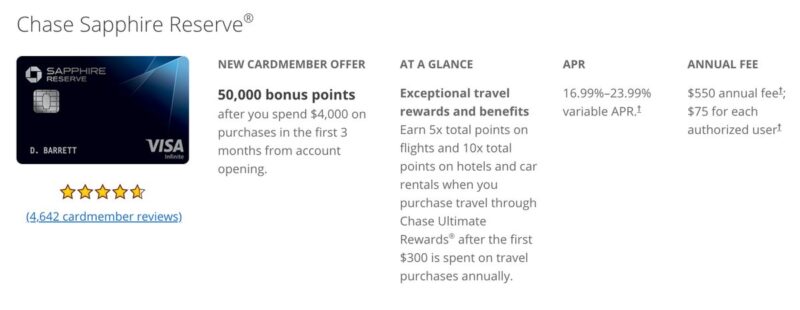

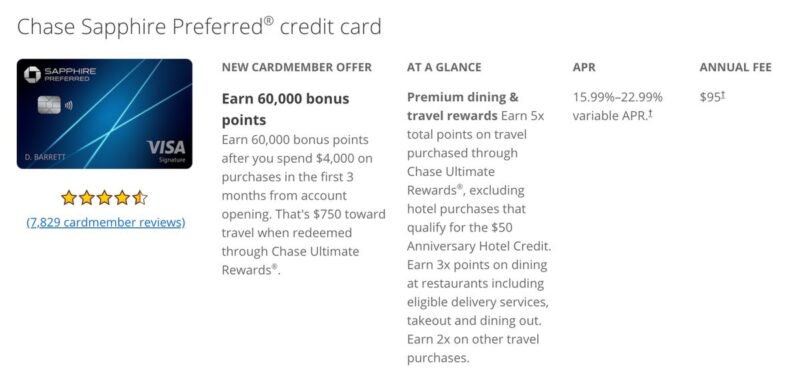

The Chase Sapphire Reserve® and Chase Sapphire Preferred® Card are great cards for traveling, coming with a whole range of fantastic perks. Both are great for traveling, but Reserve comes with better travel-related perks, such as points that are easy to rack up annual travel credit.

You’ll also get cool benefits like lounge access and up to $100 reimbursement every four years for application fees to things like Global Entry and NEXUS to make traveling that little bit more stress-free.

Both have their perks, but it does seem as though the Reserve comes with benefits geared towards those that travel more frequently and are very thankful for any little advantage they can get.

Chase Sapphire Reserve & Preferred Cards at a glance:

- Both cards come with an incredible sign-up bonus. The Preferred offers you 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening, and Reserve offers you 50,000 Chase Ultimate Rewards® Points after you spend $4,000 on purchases in the first 3 months from account opening.

- Earn plenty of rewards through making purchases.

- Reserve gives you $300 annual credit, automatically applied to travel spending.

- Get access to more than 1000 airport lounges across the world.

- When using the Preferred card, every time it is an account anniversary, earn bonus points equal to 10% of the total purchases you made the year before.

- Both have 1:1 transfer partners.

- Preferred offers $50 annual credit on hotel stays if you purchase them through Ultimate rewards.

- With a reserved card, you will access the Reserved by Sapphire restaurant booking feature.

- The Preferred card comes with more perks for everyday spending, such as 3 points for every $1 spent on dining, select streaming services, and online grocery purchases.

- Earn some big points with the Reserve, such as 10 points per $1 spent on Chase dining purchases, hotel stays, and car rentals purchased through Ultimate Rewards. 5 points for every $1 spent on air travel, and 3 points on travel and dining not booked through Chase, and 1 point per $1 on other purchases.

Learn more about the Chase Sapphire Reserve and Chase Sapphire Preferred cards.

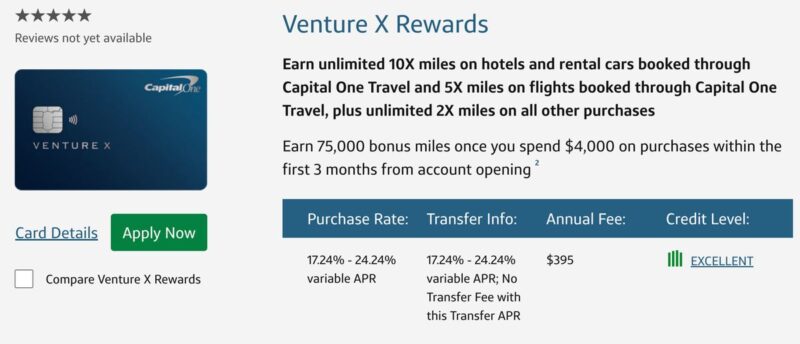

Capital One Venture X – Credit Card (This is The Card I Use NOW!)

It seems as though the Capital One Venture X Card basically wants to reward you for traveling, so what is not to love? You may get bored of reading the long list of benefits this card offers, so it is hardly surprising that this is my preferred card!

This is just as good as the Chase Reserve mentioned above except a bit better which is why I made the switch.

Compared to other similar cards, the annual fee is lower than some of its competitors, and the list of benefits certainly makes the fee worth it. Whether you are a luxury traveler or prefer to stick to a budget, this card is perfect for any adventurer who aims to explore the world.

It is Capital One’s first venture into the world of premium travel cards, and it is safe to say that they have done an incredible job, covering all the perks that you would expect would come with this kind of card, a lot with a few extras that are a nice little bonus.

Capital One Venture X Card at a glance:

- Benefit from an early spend bonus of 75,000 bonus miles when you spend $4000 within the first three months of opening your account.

- Every year, starting on the first anniversary of getting your card, you will earn points equivalent to $100 towards travel.

- Claim up to $300 for bookings through Capital One Travel, and these are offered as statement credits.

- Get up to $100 credit on Global Entry or TSA PreCheck so that you can sail through check-in.

- Get rewarded for travel with 10x miles on hotel and rental cars booked through Capital One Travel.

- Earn 5x miles on flights booked through Capital One Travel.

- Earn 2x miles on all other purchases every time you spend.

- Use free price drop protection, meaning if you book a flight recommended by the company and the price drops, you will get a partial refund.

- Let the company know if you find a better price up to 24 hours after making the booking, and they will refund you the difference.

- The company is continuously checking hotel rates so that the price beats competitors.

- Set price alerts and the company will watch your flight and let you know when the price drops.

- Get unlimited access to Capital One Lounges, with the ability to bring two free guests per visit.

- Transfer your miles to over 15 different travel loyalty programs.

- No foreign transaction fees.

- Your miles never expire, so you don’t have to worry about when you use them.

- Benefit from cell phone protection. If your phone is damaged or stolen, you can get reimbursed up to $800.

- Add other cardholders to your account for free.

- Refer a traveling friend to the card and earn up to 100,000 bonus miles if they sign up.

Learn more about the Capital One Venture X card.

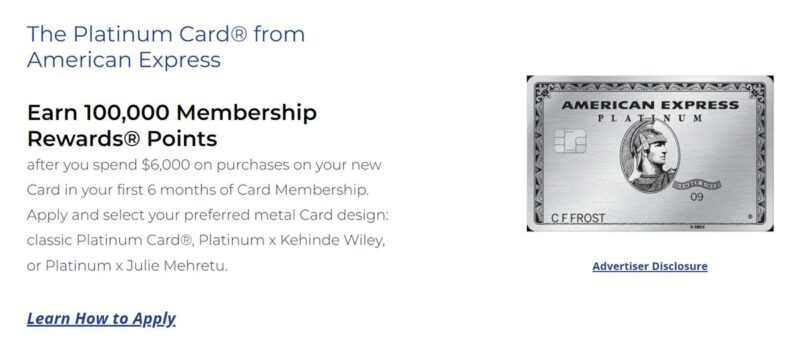

AMEX Gold and Platinum – Credit Card

Recommended by Mikaela of Voyageur Tripper

The Platinum Card® from American Express is indisputably one of the best credit cards for travelers. If you meet the spending threshold in the first six months, you’ll get enough bonus points for a round-trip flight to almost anywhere. You’ll also get bonus points for every dollar you spend, so you’ll grow your points balance faster than other cards.

While the annual fee is high, you receive a wide range of travel credits which more than offset the fee. Perhaps the best perk for travelers, however, is lounge access. You get access to lounges worldwide, most notably, the Centurion Lounges. Here you can eat and drink for free while relaxing in a comfortable chair as you await your flight.

Additional travel perks include car rental insurance, roadside assistance, baggage insurance for lost luggage, travel accident insurance, etc.

AMEX Platinum Card at a glance:

- Up to $200 Uber credits

- Up to $200 credit for airline fees

- $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which requires a minimum two-night stay, through American Express Travel when you pay with your Platinum Card®.

- Up to $179 credit to Clear (to get you through security faster)

- Access to over 1400 lounges worldwide

- Car rental insurance, roadside assistance, baggage insurance for lost luggage, travel accident insurance

- Annual fee of $695 (Rates & Fees)

- Earn 100,000 Membership Rewards® Points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership.

The American Express® Gold Card has a much lower annual fee ($250) (Rates & Fees) and provides some of the same benefits.

Learn more about the American Express Gold and Platinum cards.

Southwest Performance Business Card – Credit Card

Recommended by Karee of Our Woven Journey

The Southwest Airlines Companion Pass is one of the best deals in the travel industry. Those who earn it can bring a buddy with them anywhere Southwest flies for free. It’s the ultimate BOGO, and the savings can be huge!

You’ll need to earn the 125,000 points required to get the Companion Pass. Although that sounds like a lot, there are two ways you can reach that many points. One way is to spend enough to rack up 125,000 points. At 1x-4x points per dollar spent, you’ll have to spend quite a bit to earn that many points.

An easier way to do it is to apply for the Southwest Rapid Rewards® Performance Business Credit Card. Once you meet the required minimum spending amount, you’ll earn a large portion of the points needed for the Companion Pass.

Southwest Performance Business Card at a glance:

- 1-4 points per dollar spent

- Get reimbursed for either a Global Entry card or TSA preCheck

- 4 x upgraded boardings per year where available

- Earn 80,000 points as a sign-up bonus by spending $5000 in the first three months

If you aren’t spending enough to earn the rest of the points needed for the Southwest Companion Pass, you can get a second card like the Southwest Rapid Rewards® Premier Business Credit Card to earn all of the points required. The Premier Business Card has a sign-up bonus of 60,000 points.

Learn more about the Southwest Performance and Premier business cards.

So Which Card Is Best For Americans!?

Honestly, we are lucky, we have SO MANY CHOICES. Maybe too many? This is why I tried to just feature the best of the best above. With all of this said, there is a lot to consider.

- What’s your credit score and which card do you qualify for?

- How much do you actually travel? Are the perks going to “go to waste” or will you actually use them?

- On a similar note, do you need a card with all the extra perks, or maybe a card with a slightly lower fee and fewer rewards actually fits you best?

- Are you willing to pay off your bills EVERY SINGLE MONTH in order to actually reap the benefits of the cards? (As soon as you start paying interest, the rewards dwindle away and you’re in fact paying for them or more!)

- How much can you actually charge to your card? (If you have few things to actually put on your card you may not reach the “goal” set to get those initial points in bulk or to rack up enough to make it worth it.)

There’s a lot to consider. And what card works for me, or Joe Shmoe, or Sarah Smith, may not work for you. It is important you weigh your options, and trust me you have TONS more.

Check out and compare all of the great travel cards, their benefits, and more!

What About Saving and Investing For Americans?

I’m squeezing this topic in here because I often get asked this in conjunction with banking and card questions. Let’s get this out of the way right now: I’m no finance guru, nor am I an investment expert. By any means!

However, I can tell you that I do make my own investments, save for my retirement, and have an emergency fund using the following:

- I use Acorns, which is an excellent first step toward investing and saving! Acorns is definitely where you should start if you’re a dummy with investing, like me. They make saving and investing your money SO simple! You set it, forget it and your money gets invested for you. Start saving here!

- I use Capital One 360 Savings – which is, again, an easy basic account for some funds to sit in a high yield savings account. You’ll earn interest on the money that sits here, and yes, you can still access it. It’s a great spot for your emergency fund money to sit.

I hope this helped you find the best card to travel with!